The Middle Market

Chair: Jordan Bastable, LongWater Opportunities

Vice Chair: Heather Hubbard, Valesco Industries

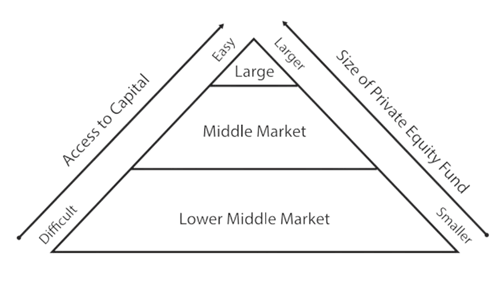

In the United States, the fastest-growing companies are middle market businesses – and middle market companies owned by private equity firms typically grow 1.5-2% faster than the middle market as a whole. Overall, nearly a quarter of the companies that make up the middle market are PE-owned. These domestic businesses account for approximately one-third of total U.S. private sector GDP and provide more than 30 million American jobs. The middle market is one of the best economic ecosystems for private equity investors to create returns. These investing firms find “little leading” companies that are ripe for development and innovation, then provide the patient capital and business expertise to help stimulate growth.

The Small Business Investors Alliance offers an environment where middle market investors can gain insight into public policy issues, as well as access to market data and senior-level networking opportunities. SBIA works with key federal government agencies and members of Congress to ensure the middle market is represented in the policy-making process and that public policy decisions positively impact small businesses across America. Members of SBIA participate in industry councils for sector-specific updates on policy and regulatory matters and educational opportunities. These groups convene regularly to discuss relevant issues and time-sensitive topics. Middle Market Council meetings often feature interactive discussions with subject matter experts and offer an industry-specific forum for members to discuss best practices to foster successful outcomes for their portfolio companies and their employees.